Trailer depreciation calculator

For tax years 2015 through 2017 first-year bonus depreciation was set at 50. When an asset loses value by an annual percentage it is known as Declining Balance Depreciation.

Plant Flower Blossom And Geranium Hd Photo By Anastasia Lysiak Nesslovetim On Unsplash Photo Lily Evans Geraniums

After five years of life with a Class C vehicle you can expect a rate of about 38 depreciation.

. It was scheduled to go down to 40 in 2018 and 30 in 2019 and then not be available in 2020 and beyond. Airstreams however will hold their value and. This depreciation calculator will determine the actual cash value of your Trailers using a replacement value and a 15-year lifespan which equates to 015 annual depreciation.

Percentage Declining Balance Depreciation Calculator. There are many variables which can affect an items life expectancy that should be taken into consideration. When you purchase a camper of any sort you can bet that theres going to be depreciation for the first few years right after you have purchased it.

With a length of 33 feet a Class C RV is the sweet spot between a camper van and tour bus. D i C R i. The market value will be 17000 if.

Other mining support services. C is the original purchase price or basis of an asset. You will see the most drastic dip in value in the first year.

Gas and oil mining. For example if you have an asset. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000.

Section 179 deduction dollar limits. Just like with motorhomes there isnt much of a difference between a one year old Class C RV and a two year old Class C RV. The MACRS Depreciation Calculator uses the following basic formula.

133 rows 1 Jul 2021. This limit is reduced by the amount by which the cost of. Fifth wheels depreciate on average 57.

Immediately following the purchase the value of your RV will be expected to depreciate over 20. For instance if you paid 20000 for the mobile home your initial depreciation. For instance If you have lived in your mobile home for two years the value has depreciated by 10.

The calculator should be used as a general guide only. Lets go back to the 20000 example. The extent that travel trailer and RV values depreciate does vary based on how many miles the RV has been driven how well its systems and interior have been taken care of.

Depreciation only varies slightly by RV type which is why we did not consider the type of RV in our RV depreciation calculator. The straight line calculation as the name suggests is a straight line drop in asset value. The Camping Nerd calculated average RV depreciation rates and.

The depreciation of an asset is spread evenly across the life. Where Di is the depreciation in year i. This will in the 2018 tax year.

Class As depreciates almost 4 on average between year 5 and 6 thats some savings right there if you plan the purchase right. The default in TurboTax is set to the 200DB depreciation method with a mid-quarter convention which is perfect for your circumstances. Reduce the sale price of the mobile home to 80 percent if it is furnished and 95 percent if it is unfurnished.

Lightweight A Frame Pop Up Campers 2022

Pin On Chart

Tm212911 10 F1a Block 41 2658724s

Rv Depreciation Everything You Need To Know Camper Report

Triple Wide Mobile Homes Floor Plans Find House Plans Mobile Home Exteriors Triple Wide Mobile Homes Mobile Home Floor Plans

Rv Depreciation Everything You Need To Know Camper Report

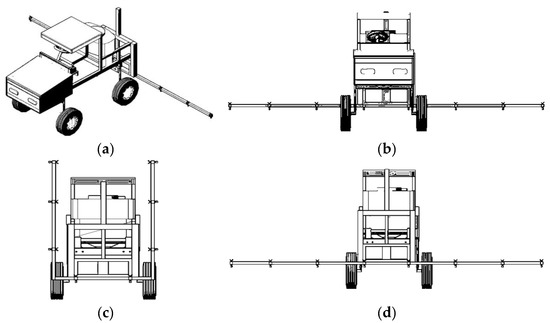

Sustainability Free Full Text Development And Evaluation Of A Prototype Self Propelled Crop Sprayer For Agricultural Sustainability In Small Farms Html

I Pinimg Com Originals Ab C0 Ac Abc0acc7380316725f

Cool Gadgets World Car Accessories For Girls Cars Organization Car Storage

Rv Depreciation Everything You Need To Know Camper Report

Overton S 2000 Lb Dual Drive Trailer Winch With 20 Strap In 2022 Winch Overton Strap

Pre Owned 2002 Ford Super Duty F 250 Lariat Crewcab 4wd Trailertowpkg Pickup Truck In The Colony 2ec44138 Reserve Auto Group

Independent Study Confirms Cost Savings Emissions Advantages For Heavy Duty Trucks Running Clearflame S Engine Technology Green Car Congress

Rv Depreciation Everything You Need To Know Camper Report

Free Iowa Mobile Home Bill Of Sale Template And Printable Form Usa Estimation Qs

How To Work Out The Value Of Your Car Car Family Car Workout

Rv Depreciation Everything You Need To Know Camper Report